Visual Art by Artani Paris | Pioneer in Luxury Brand Art since 2002

Creating a safe, accessible home environment becomes increasingly critical as we age, with home modifications potentially preventing the falls, injuries, and accidents that lead to loss of independence and forced relocation to assisted living facilities. According to the CDC, one in four Americans aged 65+ falls each year, with falls being the leading cause of fatal and non-fatal injuries among older adults—yet most falls occur at home and are preventable through environmental modifications. Research from the Journal of the American Geriatrics Society shows seniors living in properly modified homes maintain independence 3.2 years longer on average than those in unmodified environments, with 67% fewer serious falls requiring hospitalization. The good news is that making your home safer doesn’t require expensive whole-house renovations—strategic, affordable modifications in key areas create dramatic safety improvements while maintaining the comfort and aesthetics that make your house feel like home. This comprehensive guide provides room-by-room safety strategies, affordable modification options, and practical implementation advice helping you create a secure environment supporting healthy, independent aging in place for years to come.

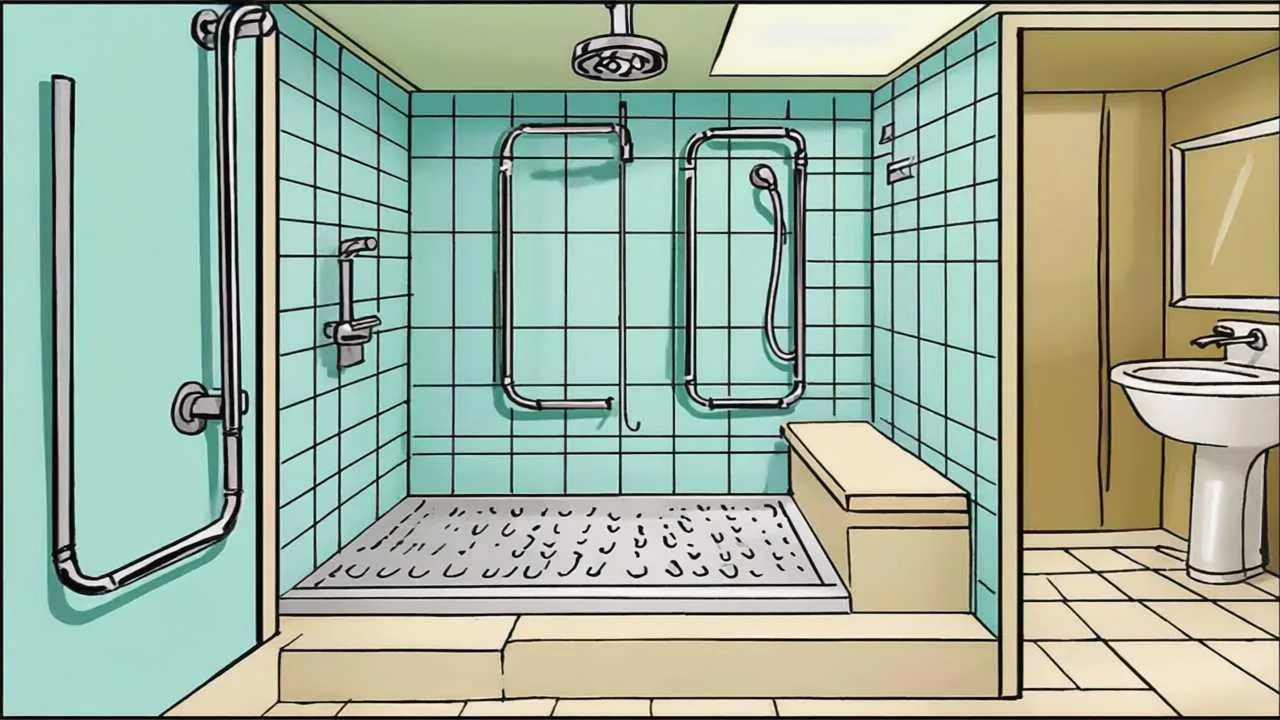

Making Bathrooms Safe: The Highest-Priority Room

Bathrooms pose the greatest fall risk in homes—slippery surfaces, wet conditions, and awkward movements required for bathing, toileting, and grooming create dangerous situations. The CDC reports that bathroom falls account for approximately 80% of home-related injuries among seniors, making this room the most critical area for safety modifications.

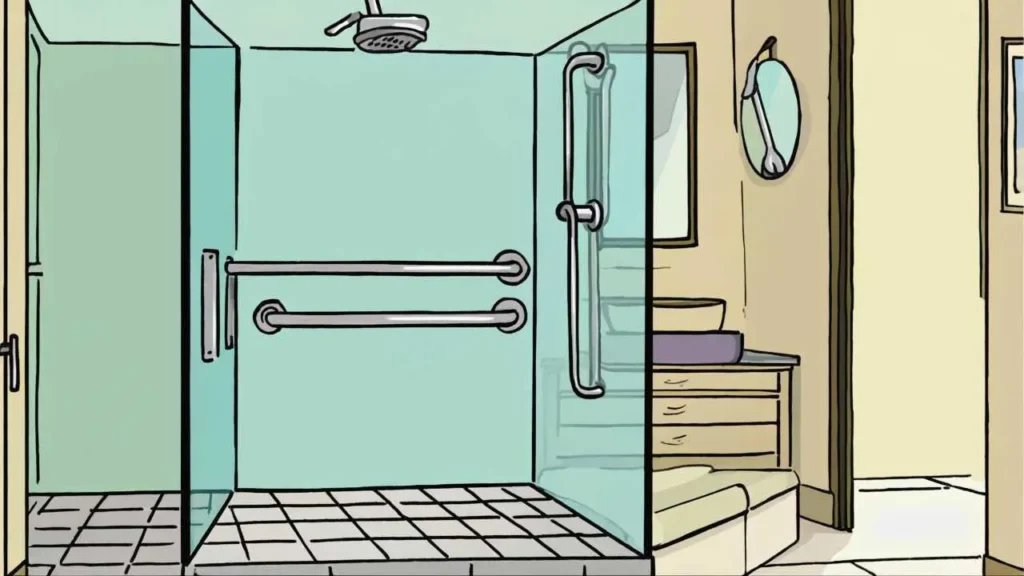

Grab Bars: Non-Negotiable Safety Investment

Installing grab bars is the single most important bathroom safety modification. These sturdy supports prevent falls during the most dangerous activities—entering and exiting showers or tubs, sitting on and standing from toilets, and maintaining balance while bending or reaching. Professional-grade grab bars must support 250-300 pounds minimum and mount directly into wall studs or with specialized anchors, never into drywall alone which cannot support your weight.

Essential grab bar locations include: inside the shower or tub (horizontal bar at waist height 33-36 inches from floor), outside the shower or tub entrance (vertical bar assisting entry and exit), beside the toilet on the wall side (horizontal bar 33-36 inches high), and near the bathroom sink if balance is an issue. Install L-shaped bars combining vertical and horizontal elements providing support in multiple directions during complex movements.

Grab bars now come in attractive finishes (brushed nickel, oil-rubbed bronze, chrome) and styles matching your bathroom fixtures rather than institutional-looking white bars. Decorative grab bars ($30-80 each) blend seamlessly with bathroom design while providing crucial safety. Professional installation costs $75-150 per bar including labor and materials, or DIY installation saves money if you’re confident locating studs and drilling properly. Never compromise on installation quality—improperly installed grab bars provide false security and can cause serious falls if they pull out during use.

Non-Slip Surfaces and Mats

Wet bathroom floors and tub surfaces become dangerously slippery, particularly for seniors with balance issues or slow reflexes. Address slipping hazards through multiple strategies. Install textured non-slip strips or decals in bathtubs and shower floors ($10-25 per set)—these adhesive strips provide traction without changing your tub’s appearance significantly. Place non-slip bath mats with suction cups inside tubs and showers during use ($15-30), ensuring they stay firmly attached and don’t slide during stepping.

Outside tubs and showers, use bath rugs with rubber backing or non-slip pads underneath preventing rugs from sliding on tile floors. Replace traditional loop-pile bath rugs with low-pile, quick-dry mats that won’t bunch or curl at edges creating tripping hazards. Consider replacing slippery tile flooring with textured, slip-resistant flooring materials ($3-8 per square foot professionally installed) if you’re planning bathroom updates—this permanent solution eliminates ongoing concerns about mat placement and maintenance.

Shower and Bath Modifications

Walk-in showers with no curbs or lips to step over are ideal for senior safety, eliminating the dangerous step-up and step-down movements required with traditional tubs and shower pans. If you have a bathtub and bathing is difficult, consider converting it to a walk-in shower ($2,000-6,000 professionally installed)—this significant investment dramatically improves safety and accessibility while often increasing home value.

For less expensive modifications, install a transfer bench or shower chair ($40-150) allowing you to sit while bathing, eliminating standing balance requirements and reducing fall risk. Hand-held shower heads ($25-80) attach to existing shower arms, allowing seated bathing and making hair washing easier without overhead reaching. Raised toilet seats ($30-80) add 3-5 inches to toilet height, making sitting and standing significantly easier for those with knee problems, arthritis, or limited mobility.

Lighting Improvements

Bathrooms need bright, even lighting eliminating shadows that hide depth changes and obstacles. Replace single overhead fixtures with multiple light sources—vanity lights on both sides of mirrors, recessed ceiling lights, and nightlights providing gentle illumination for nighttime bathroom visits. Install motion-sensor nightlights ($15-30) in bathrooms and hallways leading to bathrooms, automatically lighting paths for safe nighttime navigation without fumbling for switches in the dark.

Ensure light switches are easily accessible near bathroom entrances—you should be able to turn on lights before entering rather than navigating dark bathrooms to reach switches inside. Consider rocker-style switches ($3-8 each) requiring pressing rather than pinching, easier for arthritic hands than traditional toggle switches.

Securing Stairways and Steps

Stairs present serious fall risks—the National Safety Council reports that stairway falls cause over 12,000 deaths annually among adults 65+, with thousands more suffering serious injuries. Making stairs safer requires attention to lighting, railings, visibility, and sometimes alternatives to stair use.

Proper Railings and Handrails

Every stairway must have sturdy handrails on both sides regardless of building code requirements (which typically mandate only one handrail for stairs less than 44 inches wide). Two-sided handrails allow you to maintain support throughout climbs regardless of which hand you favor and provide critical support if one side is temporarily unusable due to carrying items or injury.

Handrails should extend beyond the top and bottom steps by 12 inches, providing support before you begin descending and after you complete climbing. Rails must be mounted 34-38 inches above stair treads and should be graspable—round or oval profiles 1.25-2 inches in diameter work better than flat profiles or decorative rails impossible to grip properly. Test handrails by pulling hard—they should feel absolutely solid without any wobble or movement. Loose handrails are dangerous, providing false security that fails when you need support most.

If your home lacks handrails or has only one, installing a second rail costs $150-400 professionally depending on stairway length and configuration. This investment dramatically improves stairway safety and often increases home value, as proper handrails appeal to buyers of all ages.

Visibility and Marking

Many stair falls occur because people misjudge step locations, particularly at the top and bottom where transitions from flat surfaces catch attention less than mid-stairway steps. Improve step visibility through high-contrast marking—apply bright colored tape or paint to step edges (nosing) creating clear visual boundaries between steps. Yellow or white contrasting tape ($10-20 for 30 feet) works well on dark stairs, while dark tape suits light-colored stairs.

Ensure adequate lighting at stair tops, bottoms, and along entire stairways. Install three-way switches allowing lights to be controlled from both top and bottom, so you never climb or descend in darkness. Motion-sensor lights eliminate the need to find switches while carrying items or if switches are inconveniently located. LED strip lights under stair nosing or along baseboards ($30-60 for 15 feet) provide gentle illumination perfect for nighttime stair use without harsh overhead glare.

Stair Treads and Carpet

Stairs should have non-slip surfaces preventing foot slippage that causes falls. If you have hardwood or tile stairs, install rubber or carpet stair treads ($50-150 for 13 steps) providing traction while leaving stair appearance attractive. Secure loose carpet or torn edges immediately—even small lifting corners can catch feet causing tumbles. Replace worn, slippery carpet on stairs rather than waiting until carpet is thoroughly worn out—the cost of replacement ($300-800 for typical residential staircases) is insignificant compared to injury costs from falls.

Remove or secure runners on stairs—loose runners slide dangerously under feet. If you love the aesthetic of runners, secure them properly with runner rods ($30-80 per flight) or carpet tacks every few inches rather than relying on friction alone.

Alternatives to Stairs

For multi-story homes where stairs become increasingly difficult or dangerous, consider alternatives preserving access to all levels. Stairlifts ($3,000-5,000 installed for straight stairs, $7,000-15,000 for curved stairs) provide seated transport up and down stairs, eliminating physical demands and fall risks of stair climbing. While expensive, stairlifts often cost less than moving to single-story housing and preserve ability to age in place in homes you love.

For homes with small step transitions between rooms or into garages, install permanent ramps ($200-800 depending on length) eliminating steps entirely. Modular ramp systems work for higher transitions, though professional design ensures proper slope ratios (maximum 1:12 slope recommended for independent wheelchair use, 1:16 for walker use) and code compliance.

Visual Art by Artani Paris

Creating Safe, Accessible Bedrooms

Bedrooms should provide safe, comfortable rest without hazards during nighttime bathroom trips when you’re groggy and vision is compromised by darkness. Falls in bedrooms frequently occur during these nighttime movements, making this room crucial for safety modifications.

Proper Bed Height and Access

Bed height significantly affects getting in and out safely. Ideal bed height positions your feet flat on the floor when sitting on the bed edge, with knees bent approximately 90 degrees—typically 20-23 inches from floor to top of mattress for most adults. Beds too low require difficult standing from low positions, straining knees and back. Beds too high force dangerous jumping or climbing down, risking falls and twisted ankles.

Adjust bed height using bed risers ($15-40 per set) adding 3-8 inches to low beds, or by removing box springs and using low-profile foundations for too-high beds. Hospital-style adjustable beds ($800-3,000) allow electronic height adjustment plus head and foot elevation, providing optimal comfort and safety for those with breathing problems, acid reflux, or circulation issues.

Ensure clear space on both sides of beds for safe entry and exit. Position beds away from walls on at least one side (preferably both) allowing unrestricted access. Keep bed sides clear of furniture impeding movement—nightstands should sit back slightly from bed edges rather than blocking side access.

Bedroom Lighting

Bedrooms require multiple lighting options accommodating different needs and times. Install bedside lamps on both sides of beds for reading and for illuminating the room when getting up at night. Use motion-sensor nightlights ($15-25) providing automatic path lighting for bathroom trips without requiring fumbling for switches. Position nightlights along pathways from beds to bathrooms, eliminating navigation in complete darkness.

Consider smart bulbs or switches allowing voice activation of bedroom lights—calling “lights on” eliminates dangerous groping for switches or lamps when disoriented by nighttime waking. Voice control particularly benefits those with limited mobility or arthritis making switch operation painful. Smart switches cost $15-50 each, while smart bulbs cost $10-25 each, with most systems working with Amazon Alexa or Google Assistant voice controls.

Floor Hazards and Trip Prevention

Keep bedroom floors completely clear of tripping hazards—shoes, clothing, extension cords, and loose rugs cause unnecessary falls. Establish specific storage locations for everything: shoes in closets or under-bed organizers, clothing in hampers or hung immediately, cords secured along baseboards rather than crossing floor pathways. This organization eliminates moment-by-moment decisions about where to place items, preventing the gradual floor clutter accumulation that creates hazards.

Remove or secure loose area rugs. Small scatter rugs slide easily on hardwood or tile floors, catching feet and causing falls. If you want rugs for warmth or aesthetics, use non-slip rug pads ($15-40 depending on size) underneath or choose rugs with non-slip rubber backing. Low-pile rugs (1/4-1/2 inch) pose fewer tripping hazards than high-pile or shag rugs where feet can catch on fibers.

Emergency Preparedness

Keep flashlights on both bedside tables for power outage situations. Motion-activated emergency lights ($20-40) provide automatic backup lighting during outages, preventing dangerous navigation in complete darkness. Keep phones within easy reach from beds—cordless phones on charging cradles ($30-70) or cell phones with large-button emergency contact settings ensure you can call for help if needed without leaving beds during nighttime emergencies.

| Room/Area | Top Hazards | Essential Modifications | Estimated Cost |

|---|---|---|---|

| Bathroom | Slippery surfaces, awkward movements | Grab bars, non-slip mats, raised toilet seat, shower chair | $200-500 |

| Stairs | Falls during climbing/descending | Double handrails, contrast tape, improved lighting | $150-600 |

| Bedroom | Nighttime navigation, bed access | Motion sensor lights, proper bed height, clear floors | $100-300 |

| Kitchen | Reaching, bending, hot surfaces | Reorganized storage, anti-fatigue mats, adequate lighting | $150-400 |

| Living Areas | Tripping hazards, furniture obstacles | Cord management, furniture arrangement, pathway clearing | $50-200 |

| Entryways | Steps, uneven surfaces, poor lighting | Handrails, ramps, motion lights, weather protection | $200-800 |

Kitchen Safety and Accessibility Modifications

Kitchens present unique safety challenges—hot surfaces, sharp objects, reaching and bending requirements, and standing duration demands make this room hazardous without proper modifications. The goal is maintaining independence in meal preparation while minimizing injury and fatigue risks.

Storage Reorganization for Easy Access

Store frequently used items at waist to shoulder height (roughly 30-54 inches from floor), eliminating dangerous reaching overhead or bending to floor-level cabinets. Move everyday dishes, glasses, cooking utensils, pots, pans, and food staples to easily accessible shelves. Use lower cabinets for rarely used items or items you can retrieve while seated. Upper cabinets above shoulder height should hold only rarely used holiday items or excess supplies.

Install pull-out shelves ($30-80 each) in lower cabinets, bringing contents to you rather than requiring kneeling or deep reaching into cabinet backs. Lazy Susans ($15-40) in corner cabinets make all items accessible with simple rotation rather than reaching awkwardly into dark corners. Drawer organizers ($10-30) keep utensils and small items sorted and visible, preventing frustrated digging through cluttered drawers.

Reducing Physical Demands

Anti-fatigue mats ($30-70) in front of sinks and preparation areas reduce leg and back fatigue during meal preparation, allowing longer standing without pain. Pull-out cutting boards and work surfaces at comfortable heights reduce awkward bending and reaching. Keep a stool or chair in kitchens for seated food preparation when possible—chopping vegetables, mixing ingredients, and other tasks often can be done while seated, reserving standing for activities truly requiring it.

Use lightweight cookware rather than heavy cast iron or thick stainless steel. Nonstick pans require less scrubbing, reducing hand and wrist strain. Replace traditional tea kettles with electric kettles ($25-60) featuring automatic shut-off preventing dangerous dry-boiling if you forget the kettle. Electric can openers ($15-35) eliminate hand strain and arthritis pain from manual openers.

Preventing Burns and Injuries

Mark stove controls clearly with large, high-contrast labels indicating off positions, making it easy to verify burners are off. Consider induction cooktops ($300-1,200) for kitchen updates—these stay cool to touch except where pots sit, dramatically reducing burn risks and automatically shutting off when pots are removed. Keep a fire extinguisher ($20-50) easily accessible in kitchens, mounted near exit doors rather than near stoves (you don’t want to reach over fires to access extinguishers).

Use timer reminders for anything cooking or boiling—smartphone timers, kitchen timers, or smart speakers all work. Set timers immediately when starting cooking, preventing forgotten items burning or boiling dry while you’re distracted. Install smoke detectors ($15-40) in kitchens and adjacent rooms, testing them monthly to ensure they function properly.

Lighting and Visibility

Kitchens need excellent task lighting for safe food preparation. Install under-cabinet LED strip lights ($30-60 per cabinet section) illuminating countertops where you work, eliminating shadows from overhead fixtures. Increase overall ambient lighting with brighter bulbs or additional fixtures—kitchens should be the brightest rooms in your home. Use warm-white LEDs (2700-3000K) providing adequate brightness without harsh, cold institutional feelings.

General Home Modifications for Overall Safety

Beyond room-specific modifications, general changes throughout your home improve safety comprehensively, creating secure environments regardless of which rooms you occupy at any moment.

Flooring and Surface Improvements

Replace slippery flooring with textured, slip-resistant alternatives when planning updates. Luxury vinyl plank flooring ($2-7 per square foot installed) provides attractive, durable, slip-resistant surfaces at moderate cost. If replacing flooring isn’t feasible, secure loose carpet edges, repair or replace worn carpet, and ensure area rugs have non-slip backing or pads underneath.

Maintain consistent flooring heights throughout homes—transitions between different flooring types often create small lips where materials meet. These height differences, even 1/4 inch, create tripping hazards particularly for those using walkers or shuffling feet rather than lifting high with each step. Install beveled transition strips ($8-20 each) smoothing height differences, or consider removing transitions entirely during flooring updates by extending single flooring types through multiple rooms.

Lighting Throughout the Home

Aging eyes require 2-3 times more light than younger eyes for comfortable vision and safe navigation. Increase lighting throughout homes, particularly in hallways, staircases, and transition areas where falls commonly occur. Replace low-wattage bulbs with brighter LEDs—many modern LEDs produce equivalent light to 100-watt incandescent bulbs while using only 15-20 watts, providing brightness without excessive energy costs.

Install motion-sensor lights ($15-35 each) in hallways, bathrooms, and entryways providing automatic lighting when you enter spaces, eliminating fumbling for switches. Three-way switches in hallways allow lighting control from both ends, preventing navigation through dark hallways to reach switches on opposite ends. Timer switches or smart switches allowing scheduled automatic lighting ensure key routes stay illuminated during times you typically move through them.

Eliminating Tripping Hazards

Conduct thorough room-by-room hazard assessments identifying and eliminating tripping risks. Remove unnecessary furniture blocking pathways or creating narrow passages. Secure electrical cords along baseboards using cord channels ($8-15) or cord clips rather than allowing cords to cross floor pathways. Remove throw rugs without non-slip backing. Eliminate floor clutter—shoes, bags, pet toys, and miscellaneous items left on floors create unnecessary hazards.

Establish and maintain clear pathways minimum 36 inches wide through all living spaces—sufficient for safe walking and wide enough for walkers or wheelchairs if needed in future. This width provides comfortable passing even when carrying items and prevents the sideways shuffle required to navigate tight spaces that can cause balance loss.

Technology for Safety

Medical alert systems ($25-50 monthly) provide emergency response access at button-push, connecting you with monitoring centers 24/7. Modern systems include fall detection automatically alerting responders if falls are detected even when you can’t press buttons. While monthly fees add up, these systems provide peace of mind for both you and your family, potentially saving lives during medical emergencies when you cannot reach phones.

Smart home technology enhances safety through voice control, automation, and remote monitoring. Smart speakers ($30-100) allow voice control of lights, thermostats, timers, and calls without physical movement. Video doorbells ($80-250) let you see and speak to visitors without approaching doors, preventing falls rushing to answer bells. Smart locks ($100-300) allow remote locking verification and emergency access for family or responders without physical key management.

| Modification Type | DIY Cost | Professional Cost | Impact Level |

|---|---|---|---|

| Grab Bars (per bar) | $30-50 | $75-150 | Very High |

| Non-Slip Mats/Strips | $10-30 | N/A | High |

| Motion Sensor Lights (each) | $15-35 | $50-100 | High |

| Stair Handrails (one side) | $80-200 | $150-400 | Very High |

| Raised Toilet Seat | $30-80 | N/A | Medium-High |

| Lever Door Handles (each) | $15-40 | $50-100 | Medium |

| Stairlift Installation | N/A | $3,000-5,000 | Very High |

| Walk-in Shower Conversion | N/A | $2,000-6,000 | Very High |

Outdoor and Entryway Safety

Outdoor areas and entryways present unique hazards—weather exposure, uneven surfaces, steps, and poor lighting combine creating dangerous conditions. Many falls occur during entry and exit, making these transition areas critical for safety attention.

Steps and Ramps

All outdoor steps require sturdy handrails on both sides regardless of step number—even single steps cause falls and benefit from handrail support. Handrails should be weather-resistant materials (powder-coated metal, treated wood, composite materials) withstanding rain, snow, and temperature extremes without deteriorating. Mark step edges with high-contrast paint or tape improving visibility, particularly important outdoors where lighting varies throughout the day and step edges may be less obvious than indoors.

For homes with multiple entry steps, consider permanent ramp installation ($500-3,000 depending on height and length) eliminating steps entirely. Modular ramp systems allow DIY installation or professional installation, providing wheelchair access and easier entry for anyone using walkers, canes, or simply finding steps increasingly difficult. Ramps require proper slope ratios (1:12 maximum for independent wheelchair use) and may need railings on both sides depending on height and local codes.

Lighting and Visibility

Outdoor entry areas need excellent lighting for safe nighttime access. Install motion-sensor lights ($30-80) at front and back doors, automatically illuminating approaches when you arrive home after dark. Dusk-to-dawn lights ($20-50) provide all-night illumination without manual switching, ensuring entry areas stay lit throughout dark hours. Solar-powered pathway lights ($30-100 for sets of 6-12) mark walkways from driveways or sidewalks to doors, requiring no electrical work and providing sustainable lighting.

Ensure house numbers are large (minimum 4 inches tall), high-contrast, and well-lit so emergency responders can locate your home quickly during emergencies. Backlit or solar house numbers ($25-60) provide 24/7 visibility without ongoing electricity costs.

Weather Protection and Surface Maintenance

Keep walkways, steps, and entry areas clear of ice, snow, leaves, and debris. Apply ice-melt products ($10-25 per 50-pound bag) liberally during winter, preventing slippery conditions on walkways and steps. Store ice melt in easily accessible locations near doors you use regularly, allowing quick application before leaving home. Consider heated entry mats ($80-200) automatically melting snow and ice from small entry areas like single steps or small porches.

Repair cracked or uneven concrete, asphalt, or paving stones creating tripping hazards. Small height differences between paving sections catch toes and cause falls. Fill cracks with concrete patch ($8-15 per container), level sunken sections with polyurethane foam injection ($500-1,500 professionally for typical residential repair), or replace severely damaged sections ($5-15 per square foot installed).

Seating at Entries

Place benches or chairs near entryways allowing seated shoe removal and rest while handling bags, packages, or mail. Entry seating proves particularly valuable after shopping trips or when arriving home tired. Weather-resistant benches ($80-250) work for covered porch areas, while simple plastic resin chairs ($15-40) provide affordable, durable seating for more exposed areas. Seating eliminates rushed, one-legged hopping while putting on or removing shoes—a surprisingly common cause of entry area falls.

Visual Art by Artani Paris

Financial Assistance for Home Modifications

Home safety modifications can be expensive, particularly major projects like stairlifts or bathroom conversions. Fortunately, various programs and strategies can help fund necessary modifications, making safety improvements accessible even on limited budgets.

Government Programs and Tax Benefits

Medicaid Waiver programs in many states cover home modifications allowing seniors to remain at home rather than entering nursing facilities. Coverage and eligibility vary by state, but programs typically cover modifications like ramps, grab bars, stairlifts, and bathroom adaptations when medically necessary. Contact your state Medicaid office or local Area Agency on Aging for specific program information and application assistance.

Veterans Affairs (VA) offers home modification grants for eligible veterans through programs like Specially Adapted Housing (SAH) grants up to $109,986 and Special Housing Adaptation (SHA) grants up to $21,996 for service-connected disability modifications. Even veterans without service-connected disabilities may qualify for Home Improvements and Structural Alterations (HISA) grants up to $6,800. Contact your local VA office or visit va.gov for eligibility information and applications.

IRS medical expense deductions may include home modifications if prescribed by doctors for specific medical conditions. Modifications improving accessibility for mobility-impaired individuals (ramps, widened doorways, modified bathrooms) qualify as deductible medical expenses. Consult tax professionals about claiming these deductions, as rules are complex and require proper documentation.

Nonprofit and Community Resources

Rebuilding Together (rebuildingtogether.org) provides free home repairs and modifications for low-income homeowners, including seniors. Local affiliates coordinate volunteer labor and donated materials making critical safety repairs at no cost. Services typically include grab bar installation, ramp construction, step repairs, and other safety modifications. Contact your local affiliate for eligibility requirements and application processes.

Habitat for Humanity and similar organizations often operate aging-in-place or home repair programs for seniors. While famous for building new homes, many affiliates now focus on modification and repair services helping seniors remain in existing homes. Services and eligibility vary by location, so contact local affiliates for program information.

Home Equity and Loan Options

Home equity loans or lines of credit provide funds for major modifications using your home’s value as collateral. Interest rates are typically lower than personal loans or credit cards, and interest may be tax-deductible (consult tax professionals). However, these loans require monthly payments and put your home at risk if you can’t repay, so consider carefully whether this option suits your financial situation.

Reverse mortgages for homeowners 62+ convert home equity into cash without monthly payments, with loans repaid only when you move or pass away. Proceeds can fund home modifications, though reverse mortgages involve fees and reduce equity available for heirs. Consult with HUD-approved counselors before pursuing reverse mortgages to ensure you understand terms and implications.

| Funding Source | Maximum Amount | Eligibility | Application Process |

|---|---|---|---|

| Medicaid Waivers | Varies by state | Low income, medical necessity | State Medicaid office |

| VA SAH Grant | $109,986 | Eligible veterans, service-connected disability | Local VA office, va.gov |

| VA SHA Grant | $21,996 | Eligible veterans, service-connected disability | Local VA office, va.gov |

| VA HISA Grant | $6,800 | Eligible veterans | Local VA office, va.gov |

| Rebuilding Together | Free (donated) | Low income homeowners | Local affiliate, rebuildingtogether.org |

| IRS Medical Deduction | No limit | Medically necessary modifications | Tax return (consult professional) |

Real Success Stories

Case Study 1: Tampa, Florida

Barbara M. (73 years old)

Barbara fell twice in six months—once stepping out of her bathtub and once on her dimly lit staircase. The second fall resulted in a fractured wrist requiring surgery, and her orthopedic surgeon warned that another serious fall could end her independence. Her daughter pushed for moving to assisted living, but Barbara desperately wanted to remain in the home where she’d lived for 40 years.

Working with an occupational therapist ($150 for home assessment), Barbara identified critical modifications needed for safe aging in place. She prioritized bathroom safety first, installing grab bars inside and outside her tub ($200 professionally installed), adding a shower chair ($60), placing non-slip mats ($25), and installing a raised toilet seat ($45). For stairway safety, she added a second handrail on the previously open side ($180 professionally installed), applied bright yellow contrast tape to all step edges ($12), and installed motion-sensor LED lights at top and bottom ($40).

Additional modifications included motion-sensor nightlights in hallways and bathrooms ($60 for four lights), removing throw rugs throughout the house, and reorganizing kitchen storage to eliminate overhead reaching. Total investment of $772 transformed Barbara’s home from hazardous to safe.

Results:

- Zero falls in the 18 months following modifications versus 2 serious falls in previous 6 months

- Maintained independent living versus facing assisted living costs of $4,000-6,000 monthly

- Increased confidence performing daily activities without fear of falling

- Daughter’s anxiety about Barbara’s safety decreased significantly, reducing family conflict about living arrangements

- Total investment of $772 (including OT assessment) provided peace of mind and prevented potential medical costs from future falls

“After my second fall and surgery, I was terrified in my own home—scared to shower, scared to use the stairs, scared to move around at night. The modifications changed everything. I feel safe again. My daughter wanted me to move to assisted living, but now she sees I can stay here safely. Those grab bars and better lighting probably saved my independence.” – Barbara M.

Case Study 2: Portland, Oregon

David and Susan K. (both 70 years old)

This retired couple loved their two-story home but increasingly struggled with stairs as arthritis and balance issues worsened. They considered selling and buying a ranch-style home but dreaded leaving their neighborhood, friends, and the home where they’d raised their children. Daily stair climbing caused knee pain, and both feared falling on stairs—a realistic concern given Susan’s two near-falls in recent months.

Rather than moving, they explored modifications allowing them to age in place in their beloved home. After researching options and consulting with contractors, they invested in a straight stairlift ($3,800 installed) eliminating physical demands and fall risks of stair climbing. They converted a first-floor office into a bedroom ($800 for closet addition and privacy upgrades) and modified the adjacent powder room with a shower insert ($1,200 professionally installed) creating a complete first-floor living suite.

These modifications allowed David and Susan to live entirely on the first floor if desired while maintaining access to second-floor bedrooms for guests. Total investment of $5,800 seemed significant initially but compared favorably to selling costs (typically 6-8% of home value plus moving expenses) and the emotional cost of leaving their community.

Results:

- Eliminated daily stair climbing pain and fall anxiety while maintaining access to all home areas

- Avoided selling costs of approximately $24,000-32,000 on their $400,000 home plus $5,000-10,000 moving expenses

- Remained in their community near friends, familiar doctors, and support networks

- Created guest bedroom suite on second floor allowing adult children and grandchildren to visit comfortably

- Increased home value by approximately $6,000-8,000 through modifications, recovering most investment

“We almost sold our house because of those stairs—we couldn’t imagine continuing to climb them multiple times daily as we got older. The stairlift seemed expensive until we calculated moving costs and realized we’d spend three times as much selling and buying a different house. Now we get to stay in the home and neighborhood we love, and honestly, we use the lift multiple times daily and wonder why we waited so long to install it.” – Susan K.

Case Study 3: Albuquerque, New Mexico

Robert T. (68 years old)

As a veteran with service-connected mobility issues, Robert struggled increasingly with his home’s accessibility as his condition worsened. He used a walker full-time and anticipated needing a wheelchair within a few years. His home had three entry steps with no handrails, a step-in shower impossible to use safely with a walker, narrow doorways barely accommodating his walker, and a toilet too low for safe transfers. He assumed he’d eventually need to move to accessible housing despite wanting to stay in his home near the VA medical center where he received care.

Robert’s VA social worker informed him about VA’s Special Housing Adaptation (SHA) grant providing up to $21,996 for accessibility modifications. Working with a VA-approved contractor, Robert installed a permanent entry ramp ($2,400), widened key doorways to 36 inches ($3,200 for four doorways), converted his step-in shower to a roll-in shower with built-in seat ($4,800), raised his toilet and added grab bars throughout the bathroom ($800), and added lever-style door handles throughout the house replacing difficult-to-grip knobs ($600 for 12 handles).

Total modifications cost $11,800, fully covered by his SHA grant. These changes transformed Robert’s home from barely manageable to fully accessible, extending his ability to age in place independently by an estimated 5-8 years according to his occupational therapist.

Results:

- Achieved wheelchair accessibility throughout home, preparing for anticipated mobility decline

- Eliminated dangerous step navigation and awkward doorway maneuvering risking falls and injury

- Zero out-of-pocket costs through VA SHA grant—$11,800 in modifications fully funded

- Extended projected independent living by 5-8 years, saving estimated $240,000-480,000 in facility care costs ($4,000-6,000 monthly for 5-8 years)

- Remained near VA medical center providing specialized care for his service-connected conditions

“I had no idea the VA would pay for all these modifications. I thought I’d have to move to some accessible apartment complex away from my doctors and the VA hospital. Instead, my house is now fully accessible—I can get in and out independently, use my bathroom safely, and move throughout my home with my walker or wheelchair when I eventually need one. These modifications changed everything. Every veteran should know about these benefits.” – Robert T.

Frequently Asked Questions

Do home safety modifications decrease home value?

Most safety modifications either maintain or increase home value, contrary to common concerns. Grab bars, improved lighting, non-slip surfaces, and handrails appeal to buyers of all ages as “universal design” features. Major modifications like stairlifts can be removed before selling if buyers don’t need them, while walk-in showers, ramps, and widened doorways typically increase home value by improving accessibility. Real estate agents report that homes with safety and accessibility features often sell faster and for higher prices than comparable homes without them, as aging Baby Boomers increasingly seek move-in-ready homes requiring no modification work.

Should I make all modifications at once or gradually over time?

Prioritize modifications addressing your most serious fall risks and mobility limitations first, then add others over time as needed and budget allows. Start with bathroom grab bars, adequate lighting throughout, and stairway handrails—these prevent the most common and dangerous falls. Add other modifications gradually unless you’re recovering from falls or injuries requiring immediate comprehensive changes. Gradual modification allows spreading costs over time and ensures you invest in modifications you actually need rather than anticipating problems that may never occur. However, if you’re planning other home updates (bathroom remodels, flooring replacement), incorporate accessibility features during those projects rather than making separate modifications later.

Can I install safety modifications myself or should I hire professionals?

Simple modifications like non-slip mats, nightlights, lever door handles, and cord organization are easy DIY projects requiring no special skills. Installing grab bars requires finding wall studs and drilling properly—DIY is possible if you’re confident with tools, but improper installation creates dangerous false security. Handrails, lighting modifications requiring new electrical work, and any structural changes (ramps, doorway widening, bathroom conversions) should be done by licensed professionals ensuring safety, code compliance, and proper installation. When in doubt, hire professionals—the cost difference is small compared to injury costs from failed DIY installations. Many handyman services charge $50-100 per hour for simple installations like grab bars and handrails, providing professional installation at reasonable costs.

How do I know which modifications I actually need?

Consider professional home safety assessments by occupational therapists ($150-300) who evaluate your home identifying specific fall risks and mobility challenges based on your current and anticipated needs. OTs provide prioritized recommendations and can write prescriptions for modifications potentially covered by insurance or qualifying for tax deductions. Alternatively, free or low-cost assessments are available through Area Agencies on Aging (find yours at eldercare.acl.gov) offering home safety evaluations, or through organizations like Rebuilding Together if you qualify for their services. You can also conduct self-assessments using free checklists from CDC, National Institute on Aging, or AARP, though professional assessments identify issues you might miss.

Will Medicare or insurance pay for home modifications?

Traditional Medicare does not cover home modifications like grab bars, ramps, or stairlifts, though it covers durable medical equipment like shower chairs, raised toilet seats, and walkers when prescribed by doctors. Medicare Advantage plans sometimes cover home safety modifications as supplemental benefits—check specific plan details. Medicaid waiver programs in most states cover home modifications for eligible low-income seniors, though coverage varies by state. Long-term care insurance policies may cover modifications if you’re receiving benefits. Private homeowners insurance doesn’t cover accessibility modifications but may cover repairs if damage from falls or accidents necessitates modifications. Check specific policies and consult with insurance agents about potential coverage.

How can I make modifications without making my home look institutional?

Modern safety products come in attractive finishes and styles blending with home decor rather than looking medical or institutional. Grab bars are available in oil-rubbed bronze, brushed nickel, chrome, and other finishes matching bathroom fixtures. Decorative grab bars incorporate towel bar styling looking like intentional design elements. Stair handrails come in wood, metal, and composite materials matching existing trim and design aesthetics. LED lighting with warm color temperatures (2700-3000K) provides bright, safe lighting without harsh institutional feelings. Focus on universal design principles benefiting everyone rather than appearing specifically disability-oriented. Many safety features—lever handles, adequate lighting, non-slip surfaces—are simply good design appropriate for all ages and abilities.

What if I’m renting and can’t make permanent modifications?

Many effective safety modifications require no permanent changes and can be implemented in rentals. Use suction-cup grab bars ($20-50) in showers and near toilets—while not suitable for full weight-bearing, they provide balance support for most situations. Add motion-sensor plug-in nightlights, non-slip mats, shower chairs, raised toilet seats, and improved lighting through floor and table lamps. Secure cords with removable cable channels. Use furniture risers to adjust bed and seating heights. Discuss critical modifications like grab bars or handrails with landlords—many will install or allow installation if you offer to cover costs, as modifications increase property value. Document all modifications before moving in and plan restoration if required when moving out, though many safety features actually make properties more marketable to a wider range of tenants.

At what age should I start thinking about home safety modifications?

Start implementing basic modifications in your 60s before falls or injuries force reactive modifications, allowing gradual, affordable improvements rather than expensive emergency changes. Many modifications benefit all ages—adequate lighting, clutter-free pathways, non-slip surfaces—making implementation sensible at any age. However, focus intensifies after age 65 when fall risks increase significantly. If you’ve experienced falls, near-falls, or notice balance or mobility changes, implement modifications immediately regardless of age. Proactive modification prevents injuries rather than responding to them, and early modifications allow time to adjust to changes like using grab bars or handrails that feel odd initially but become automatic with use. Think of safety modifications as preventive healthcare—addressed early, they prevent problems rather than fixing damage after it occurs.

How do I convince a parent or spouse that modifications are needed?

Resistance to modifications often stems from denial about aging or fear that changes make homes look institutional. Approach conversations focusing on maintaining independence rather than limitations—modifications allow longer independent living rather than acknowledging disability. Share statistics about fall risks and consequences, noting that falls are the leading cause of forced moves to assisted living. Suggest starting with small, non-invasive changes (better lighting, decluttering) allowing them to experience benefits before major modifications. Consider professional home assessments by occupational therapists providing objective, expert recommendations hard to dismiss as overconcern. After falls or close calls, act quickly during windows when resistance is lower and necessity is obvious. If appropriate, involve their doctors who can prescribe modifications as medical necessities, increasing psychological acceptance. Emphasize that modifications are investments in future freedom, not admissions of current incapacity.

What modifications provide the best return on investment for safety?

Bathroom grab bars provide the highest safety return on investment—relatively inexpensive ($30-150 per bar installed) but preventing the most dangerous and common falls. Improved lighting throughout homes ranks second—affordable ($100-300 for whole-home improvements) but dramatically reducing falls during nighttime navigation. Stair handrails (preferably both sides) are third—moderate cost ($150-400 per flight) preventing falls on the most dangerous home feature. These three modifications address the vast majority of senior home fall risks at combined costs of $280-850, providing maximum safety improvement for minimum investment. Additional modifications should be prioritized based on individual fall risks and mobility limitations identified through home assessments. Don’t postpone these critical modifications trying to save money—fall-related injuries cost far more than preventive modifications both financially and in quality of life impacts.

Action Steps to Make Your Home Safer

- Conduct room-by-room home safety assessment using free checklists from CDC or AARP, photographing hazards and noting specific concerns about falls, reaching, or access difficulties

- Prioritize bathroom modifications first—install grab bars inside/outside tub or shower, add non-slip mats, consider raised toilet seat and shower chair based on current mobility and balance

- Improve home lighting throughout by replacing low-wattage bulbs with bright warm-white LEDs and installing motion-sensor nightlights in bathrooms, hallways, and any areas you navigate at night

- Ensure all stairways have sturdy handrails on both sides, apply high-contrast tape to step edges, and add lighting at tops and bottoms of stairs controlled by three-way switches

- Eliminate tripping hazards by removing unnecessary rugs without non-slip backing, securing electrical cords along baseboards, decluttering floors, and maintaining clear 36-inch-wide pathways throughout your home

- Reorganize kitchen and bathroom storage placing frequently used items at waist to shoulder height (30-54 inches), eliminating dangerous overhead reaching and floor-level bending for everyday items

- Research financial assistance programs including Medicaid waivers, VA grants if you’re a veteran, local nonprofit home repair programs, and potential tax deductions for medically necessary modifications

- Consider professional home safety assessment by occupational therapist ($150-300) providing expert recommendations prioritized to your specific fall risks and mobility challenges

- Create modification budget and timeline starting with highest-priority safety issues (bathroom, stairs, lighting) and adding other improvements gradually as funds allow over 6-12 months

- Install medical alert system ($25-50 monthly) with fall detection providing emergency response access if falls occur despite modification efforts—prevention is primary, but backup plans ensure safety

Disclaimer

This article is provided for informational purposes only and does not constitute professional medical, safety, or construction advice. While modification strategies discussed generally improve home safety for seniors, individual needs vary based on specific health conditions, mobility limitations, cognitive status, and home configurations. Consult qualified professionals including occupational therapists, certified aging-in-place specialists, licensed contractors, and healthcare providers before implementing modifications, particularly those involving structural changes or electrical work. Building codes and safety standards vary by location—ensure all modifications comply with local requirements. Financial assistance program eligibility and benefits change frequently—verify current program details through official sources before making decisions based on this information.

Information current as of October 2, 2025. Safety standards, product availability, costs, and assistance programs may change. Always verify critical information with qualified professionals and official program sources before implementation.

Related Articles

- Senior Housing: Choosing the Right Community in 2025

- Easy Interior Ideas to Create a Cozy Retirement Home: Complete Design Guide

Updated October 2025